I enjoyed watching Container Solutions’ Jamie Dobson present an introduction to their pattern language for strategy yesterday, titled “A framework for strategy, making decisions in turbulent times”. I recommend viewing the recording, ‘A Pattern Language for Strategy’. Below are my main takeaways.

Table of Contents

- A framework for Strategy

- Strategy is a process

- Characteristics of the Strategist

- Getting ready to gamble

- Don’t miss opportunities

A framework for strategy

At QWAN patterns are in our DNA, and I’m learning about strategy, so this talk fits.

This pattern language is also available as

- A book and a pattern library, at cnpatterns.org

- A series of blog posts.

There is much to say about it, but following Bias to Action, I’ve set myself a deadline and will post my first takeaways.

Bias to Action was mentioned in the presentation, but I could not find it as a pattern (yet?).

The titles below taken from the presentation slides or the e-book.

Strategy is a process

“Strategy is a process, Strategy is not a plan or an edict handed down from on high, but rather the cumulative results of many, many actions”

I’ve experienced Strategy handed down, in situations where strategy was inflicted on development teams I worked in. A collaborative strategy could have massively reduced risk, time to market and costs. The miracle of close collaboration and high trust inside a team can make it work regardless. That doesn’t mean the strategy was sound, the process was good or the human cost was low.

I like the focus here, it takes patience and time. And you have to work it. Together.

Characteristics of the Strategist

The strategist has four characteristics:

Empathy, Understanding of Reality, Imagination and Voice

“Don’t confuse empathy with weakness”

“Imagination is a cheap place to do work”

The example of Kennedy proposing to putt a man on the moon given with understanding of reality is food for thought. That was one complex reality.

Voice: “It’s no good imagining what can be, understanding reality, and representing your people if you cannot speak.”

Getting ready to gamble

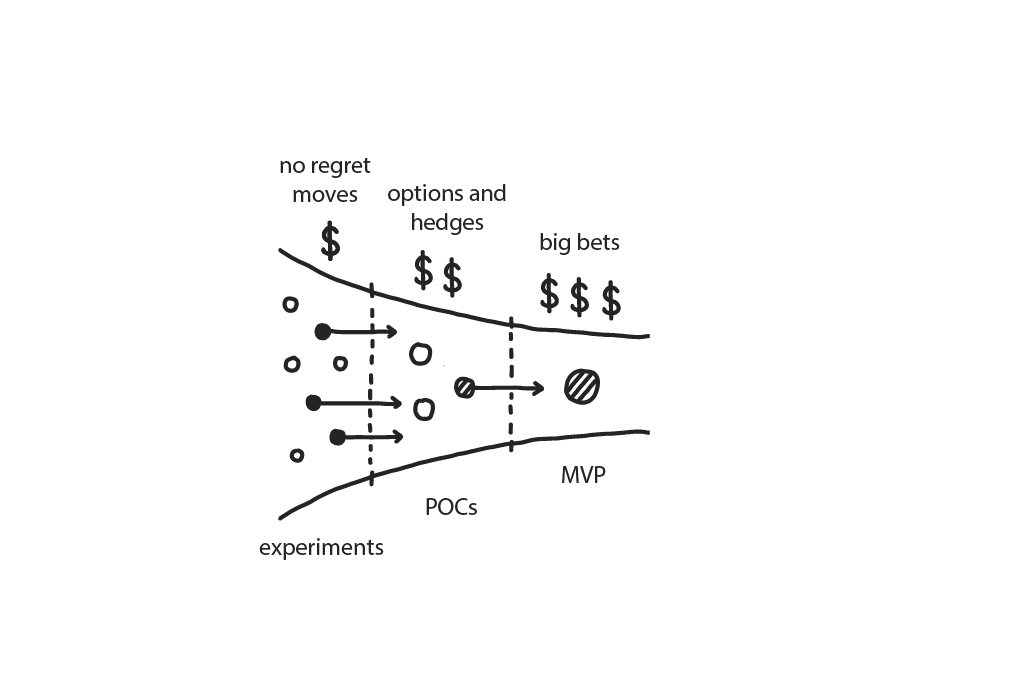

What hadn’t dawned on me, even with the visual, right there, in each of the patterns, was that one can represent No Regret Moves, Options and Hedges and Big Bets as a funnel.

The picture shows a narrowing funnel, with more things done in the earlier stages and fewer later:

- Experiments on the left are the mechanism for No Regret Moves,

- Proofs of Concept to execute Options and Hedges,

- and Minimum Viable Products for Big Bets.

Each item gets more expensive as one moves to the right of the narrowing funnel.

The funnel is shown in each pattern. Sometimes I need to see, read, and hear things a few times before they settle.

No Regret Moves teach us what is possible, and what has value without risking a thing. From there on, we can do small, slightly riskier, investments, with Options and Hedges, and then we have to muster our courage, and do a Big Bet.

There is a trap in seeing no regret moves as incremental change only. No regret moves also includes work that doesn’t increment a thing, or, on the contrary, informs us that we should not do a thing. An experiment gives us information about what is possible, what we or our competitors might do in the future, and what is around us. It doesn’t necessarily move us forward.

Don’t miss opportunities

Discussing on the difference between incremental change and No Regret Moves afterwards, Jamie said: “People who are timid favor incremental change, and may miss big opportunities.”

I have a tendency to be timid, maybe that is why I tend to favor incremental change. I’ve got work to do.